Transmission Channels of Central Banking and QE

The QE debate has spawned a renewed interest in the transmission channels of Central Banking. For a long time through the Great Moderation, all central banks were using the interest rate channel, and that alone was sufficient. In fact, so successful has this channel been, that people seem to have forgotten the other transmission channels. The diagram below summarises the traditional transmission mechanisms of central banking, courtesy of Mishkin:

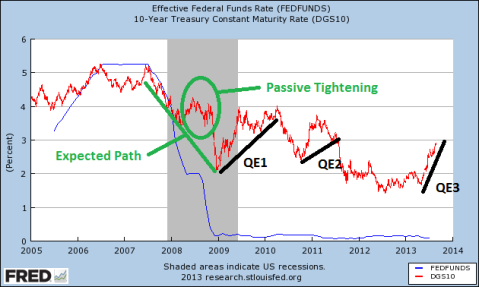

These channels are separated into three broad channels, interest rate, other asset price effects, and the credit channel. In my view there is at least one more channel that should be mentioned explicitly, and that is expectations. However, expectations are implicit in nearly all of the channels. Even in the interest rate channel, expectations for the ten year yield often start falling dramatically even before the Fed cuts rates, since expectations of recession fuel expectations of a rate cut, and can ease policy dramatically even before the Fed takes any “concrete steppes”. It is for this reason that Lars Christensen and Scott Sumner continually say that Monetary Policy works with “long and variable leads”. Indeed, in the run up to the financial crises one could argue that the Fed’s decision to leave rates on hold at 2% in mid 2008 represented such a passive tightening compared to expectations, which led to a spike in the ten year yield. I would not argue thus, arguing quite the reverse, that the Fed’s belated cut to 2% showed the Fed was “taking it seriously” and this raised expectations of future growth, At that point perhaps most actors were still foreseeing a garden variety recession, then in late 2008 it all started getting worse again and long rates plunged and expectations fell. Then QE came along and raised them again. Let me note again for clarity, that I do not believe this argument, but if you think that the interest channel is the primary channel of monetary policy, as reflected in the long rates, then you must believe that the Fed tightened policy relative to expectations in mid 2008 when it lowered the Fed Funds rate to “only” 2%. My only point here is to shine a light on the difference in interpreting the effects of monetary policy moves. Market monetarists believe that lowering the fed funds rate always and everywhere leads to higher NGDP expectations and hence higher ten year rates.

At any rate, the main point of this post was to look at transmission mechanisms for QE. The first and most important thing to notice is that QE does not work by “holding down interest rates”. In fact it has the reverse effect. Every episode of QE has been associated with rising interest rates. To many people it seems “obvious” that buying securities “must” hold down the rate, so let us reflect on this, and the general unreliability of interest rates as a measure of, well, anything. Firstly, it is the case that ten year rates are highly correlated with expectations of NGDP growth. This is because if I expect ten years of 5% NGDP growth, then I can obtain 5% nominal growth risk free by buying a portfolio which is representative of the “whole economy”. Admittedly this is not likely true in practice, but any risk free security should be priced according to this ideal. Thus rising real rates are correlated with higher real GDP in the future. We should therefore conclude that if QE leads to rising nominal long rates, then it is because one of the other transmission channels overwhelms the interest rate channel, and leads to rising rates based on recovery expectations despite the headwinds that a rising interest rate has on growth. Indeed, some support was given to this view by a careful analysis of correlations between gdp growth and long interest rates by the econtrarian – which showed that rising 10 year interest rates are strongly correlated with GDP growth.

Of course, it can be even more complicated than that. After all, the stimulative effect of low interest rates is driven by the difference between the current cost of capital and the Wicksellian real interest rate. As David Glasner has pointed out, if rising demand causes the Wicksellian rate to rise, the stimulative effect of low interest rates can rise even as long rates rise, if they rise less slowly, and it is perfectly consistent to believe that. I.e., to believe that QE does hold down rates relative to the counter factual where stimulating the economy was achieved through some other channel than buying securities.

Now there are several channels through which QE may effect the economy. The first is that by holding down MBS relative to other corporate credit, it has lowered mortgage rates and this has supported the housing market and allowed households to refinance at lower rates and so supported consumption. The second are portfolio balance and wealth effects, and the final one is the signalling effect(into which I group changes in inflation expectations).

The first of these needs little explanation, but there is some evidence that this has been a major factor. A recent Jackson Hole paper (this I think – same authors anyway), one criticism I would level is that their event analysis on QE announcements is very short term, and so misses the dominant narrative to liquidity effects. Nevertheless, by looking at many different channels, they find that QE has had a lot of small effects which adds up to quite a big effect, and it is an excellent paper for illuminating the many different effects that QE has in the economy.

Portfolio re-balancing effects are the Fed’s fancy name for what Scott Sumner calls “the hot potato effect”. Suppose that the public, in general, have some preferred portfolio of assets. If you go and buy some assets, you take them out of circulation, however, whoever you bought them off must now hold more cash than he desired. Said investor will now try to get rid of his excess cash by buying something else (either consumption or another asset). However, in aggregate the public cannot “get rid” of their cash, so they must return to their preferred portfolio through a complicated series of transactions that ends up, eventually, in the adjustment of prices. Part of this adjustment involves bidding up asset prices, in the expectation that in the new equilibrium there will be more spending, and hence a higher nominal return. We can see this in action in this graph of corporate profit forecasts in Japan, produced by Pragmatic Capitalism

This is the graph of forward earnings for the major stock indices.

Asset prices rise, because they forsee a future in which spending is higher, and hence revenues and profits are higher. Note that we expect this to be both nominal and real improvement, if the economy was at capacity already before QE was undertaken, we would expect only a rise in the price level, and no rise in output, with developed economies still far from capacity, we forsee both a rise in real output and a moderate increase in the price level, both of which drive corporate profits higher. (As previously pointed out QE does not actually improve corporations nominal financing position).

This is exactly Hume’s age old thought experiment about doubling the amount of gold in circulation will eventually double all prices and lead to no one being better off. Similarly, the creation of cash drives the economy towards a new equilibrium where every economic actor holds cash in the exact same proportion that they did pre-expansion. The process of adjustment is not guaranteed to be quick, but by controlling the stock of money the Fed can control the end point. Note that since M2 >>> Monetary Base, it requires incredibly large proportional expansions in base money to “make up for” quite small declines in lending. It was a failure to appreciate this point that has led to chronic deflation in Japan: Lars Christensen produced this scary graph:

We can understand this immediately by looking at the Japanese Money supply – the central bank made no attempt at all to offset the sharp departure from trend growth in the money supply, and the result was chronic deflation. Some of this was hidden by the divergence of the CPI and the GDP deflator shown above.

Note that since the money expansion in 2002 was expected to be temporary – money growth was restricted in the years following QE, and indeed, in 2006 the BoJ raised interest rates, as inflation was getting out of control, it almost reached one percent – it had little effect on the CPI. Indeed, the Japanese Phenomenon is best understood as BoJ targeting zero percent inflation in the CPI, which is exactly what it achieved.

We should also note that, quite apart from the portfolio affects listed above, higher equity prices makes investment cheaper. Not all investment is funded through bonds, and many actors prefer not to be over-leveraged, and so they may issue equity capital instead of bonds. Higher equity prices stimulate investment through this channel also. There may also be a “wealth effect”, in that those saving for pensions may save less on seeing their portfolio grow in value, and lower saving rates lead to more consumption.

Finally, we get to signalling effects. Signalling effects on real interest rates are important, because they help to shape future expectations. The Evan’s rule, in which they promised not to taper until unemployment reached a certain threshold resulted in a larger move in yields than either of the previous rounds of QE, as it helps shape expectations of future fed policy. In particular, if you as an individual have a worse expectation than the market consensus you will expect more asset purchases, which will moderate up your view of future growth, and so it acts like a positive feedback measure on expectations. Moreover, since expectations of future demand are exactly what drives investment now, raising expectations can have concrete effects in the present. I will write more on the expectations channel in a future post.

In conclusion then, I think that QE works neither through “holding down long rates” as some old style Keynesians apparently believe, nor through “expanding bank lending”, but through expanding the cash base of the economy, which leads to higher expectations of future nominal growth, and hence, more investment in the present. Added to this are the small but not negligible effects of holding down mortgage rates relative to other securities to allow cheaper refinancing, and the direct effect of rising wealth on consumption, mainly through a reduced saving rate for retirement by both persons and corporations (do not forget that low long interest rates make defined benefit plans much more expensive).