Where is all the Deflation?

So there has been a lot of chatter on the blogosphere about “where is all the inflation” that QE was supposed to be generating. Frances Coppola thinks QE may be deflationary. FT Alphavilla commentator Kaminska seems to have a similar view. A lot of people think that the purpose of QE is to generate higher inflation, which I am not convinced is possible in the current environment. This post sets out my view.

I never expected either deflation or inflation. My view is that we have suffered a deflationary shock, and in a frictionless environment prices and wages would have fallen rapidly to reflect the new, higher, price of money. Along with plenty of painful defaults. However, that is not the world we live in. Prices are downwards sticky, and as a result, we have had a protracted unemployment crises. There are two ways for this to end, either the central bank, perhaps in concert with fiscal agencies, ups aggregate demand (spending) to the point where wages are sufficient to purchase all output at the given value of money, or prices fall until wages are sufficient to purchase all output at the given level of spending.

I should briefly mention what I consider a deflationary shock to mean. In essence, if you define Say’s Price of Money as Potential GDP/NGDP , then you get the value that money would have to have in order to purchase all of the output (i.e. enforce Say’s Law), at the given level of spending. Any time this value rises sharply, you are in a deflationary shock. So Deflation = Falling NGDP.

The US is currently doing both, slowly. QE has raised NGDP, at least compared to the obvious counter-factuals of 1990s Japan and the current Euro Catastrophe. Thus, NGDP is rising, and wages are falling, and when they meet, then QE will become inflationary, until they meet (at the level sufficient to purchase all output), wages will keep falling as fast as they can (until the output gap has closed). Thus, a need for QE precludes it from being inflationary. It is not an accident that headline inflation in the EZ and in the US are very similar despite vast US QE.

Difference in QE has resulted in difference in NGDP, not in differences in inflation. (Graph via David Beckworth)

US and EZ inflation indistinguishable, despite differences in Monetary Policy

The point here, is that for as long as spending is insufficient to purchase all output, wages will adjust downwards as fast as they can, given sticky wages, until the given level of NGDP is sufficient to purchase all output – i.e. the output gap is closed. The easy way to reduce the output gap is to increase spending. If you do too much, you get a little inflation, but that is a small cost compared to the trillions of dollars of lost output. Since inflation will remain stuck to the floor, the effect of QE is to bring forward the point at which the output gap has vanished by raising NGDP. Thus, our expectations for future inflation should look like this:

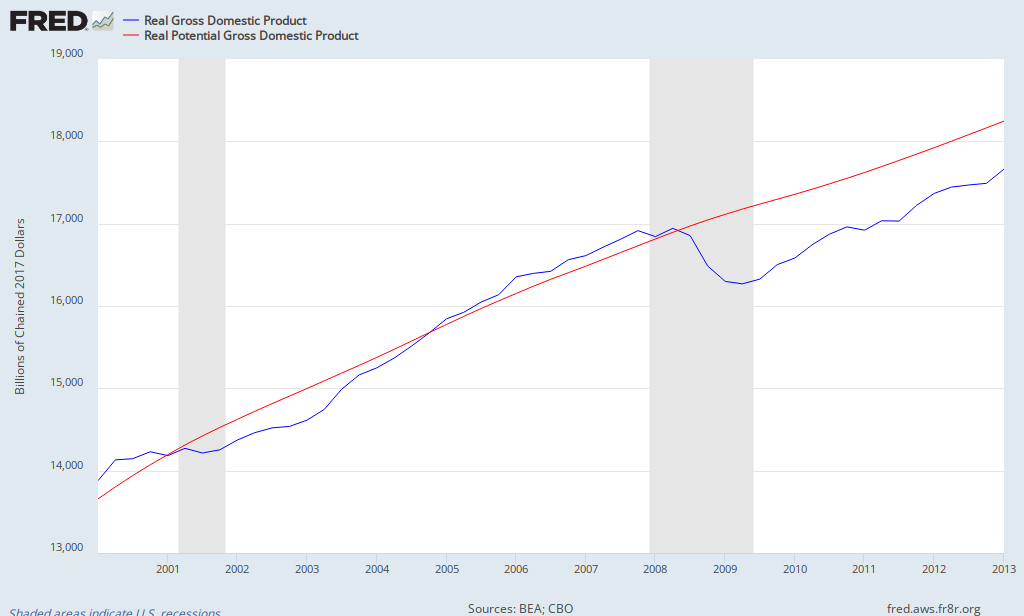

To ask, “when will this happen” is to ask when will the output gap close, for the US, at current rates, we are talking about a decade:

Not a lot of progress in closing the output gap so far. Time to up purchases? At least its not getting any wider. That looks pretty good from where I am sitting in a European country….

All in all, I am amazed that anyone things the FOMC is going to taper purchases at this meeting. They are more likely to expand the programme than to taper it in my view.

UPDATE: BB does not Taper, will do so when unemployment falls to 7%, maybe.