The depressing state of the Eurozone

The ECB continues to destroy the Eurozone. Jens Weidmann continues to make a fool of himself pretty much every time that he opens his mouth. Austerity continues not only to fail but to destroy the economies of the Eurozone at the same time. Jens Weidmann warns France about the dangers of not sticking to austerity. The Fed has made history. Its growth and employment forecasts have now been more optimistic than the fact for forty consecutive quarters. A truly staggering observation.

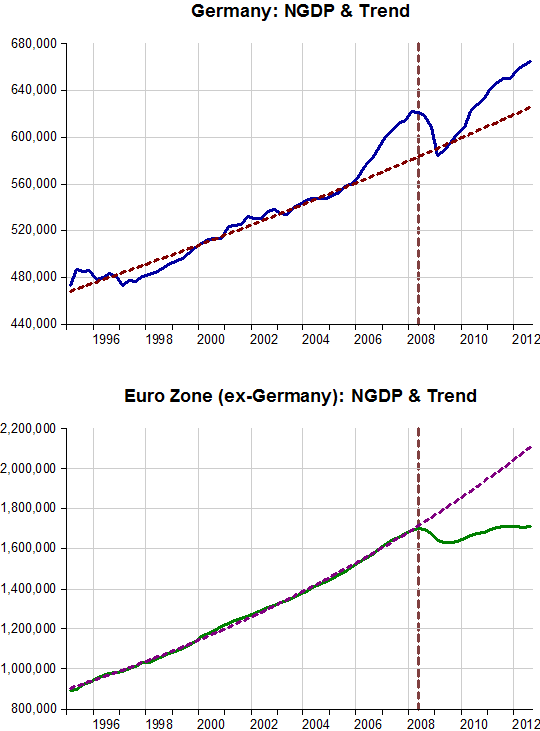

They say that a picture says a thousand words. Well here is my picture.

Unemployment in the Eurozone

Eurozone employment is now approaching 11%. The lessons of the depression tell us that unemployment will continue to increase every month that NGDP growth stays below trend. Marco Nunes offers us some graphical insight:

Credit to Nunes

The first graph shows the heart of the political problem in the Eurozone. If the Eurozone economy is to re-balance Wages in Germany must rise, because German workers are more productive. Germany currently has 1.4 million workers earning less than 5 euros an hour. The real secret of German success is a vast underclass that works for a pittance combined with inflation so low that it prevents any meaningful re-balancing of wages. Rowntree will be weeping in his grave.

Germany workers must accept wage increases if the Eurozone economy is to re-balance You would think persuading workers to accept pay increases would not be so hard, but as we all know, increasing wages is inflation. And there is nothing more certain than that the German political elite cannot accept inflation. Thus German workers accept less than their fair share, which crushes the periphery economies as they cannot compete on price given their relatively overpriced labour and lower capital investment. The Eurozone cannot recover without NGDP growth. Whatever NGDP growth you generate in the Eurozone will not be evenly spread until productivity has balanced out, so Germany `suffers’ from above trend NGDP growth even while the Eurozone falls apart due to insufficient demand.

Eventually, the price of labour will reach an equilibrium. Either through the relatively painless route of higher NGDP growth and some inflation in Germany, or through mass unemployment and wage cuts, coupled with sovereign defaults, or through mass immigration from the worse performing regions into the better performing ones. Germany is ruling out the first one, happily imposing the second upon the Eurozone periphery. Even France has become a target of the Bundesbank due to its higher than agreed deficits. I fear that the near limitless capacity of Eurozone electorates to accept the pain imposed by the witless ECB is reaching its end. The ECB has to act.

My pessimism about the ECB and its policies knows no limit. So I have put my money where my mouth is and have cashed out a substantial portion of my long positions in the equity markets last week.