Understanding Interest Rates

Ever since Scott Sumner suggested that someone needs to put together a model for market monetarism it is something I have been thinking about. My background is physics, and I have had only a very limited exposure to the world of building economic models, but it seems that most macroeconomic models are some form of equilibrium analysis. Market monetarism is fundamentally about disequilibrium.

This post introduces the concept of the natural rate of interest, and shows how changing the interest rates allows one to introduce disequilibrium and hence violate some of the most fundamental accounting identities, that much of equilibrium analysis 101 depends on.

Let us make a few assumptions about how the world works. First, actors have a savings preference, , where

is the real interest rate, and the savings preference is expressed as a percentage. All we are saying here is that saving preferences respond to the real interest rate, i.e. people save more when interest rates are higher. Secondly, workers have some function that describes their productivity. One of the inputs to this is

which is the capital invested in said worker. Let us say that

, where the ellipsis stands for all the other inputs which matter. Now, if I can borrow money at interest rate

, and use it to increase

and hence

, then I should do that as long as the marginal rate of return on

is higher than the interest rate. In other words,

Let us assume that this expression is invertible for . Now capital is persistent, up to some depreciation, so I should consider that if

, then the capital spending is

, where the subscript denotes the year/time period, and the

stands for depreciation.

By construction then, the total amount of saving is , where

is national income, and the total capital spending is

. Now, we have two terms, saving increases with

, and capital spending decreases, so we can always choose an interest rate such that these two terms match exactly. We call this the natural rate of interest.

We can now write down the national expenditure identity:

Now the three terms are clearly understood. The first is consumer spending, which is income less savings and taxes, the second is capital spending, and the final one is government spending. Since everyone’s spending is some one else’s income, we should have GDP=GNI, However, this type of equilibrium analysis misses the point, as my spending is based on my previous income. If we imagine that everyone is paid once a year on a particular day, then we see that our years expenditure, saving etc, its based on our previous income. Let us assume that the real production of the economy is fixed. Then if the interest rate is at the `natural rate’, and the government runs no deficit, then we get zero expenditure growth – the price level is fixed. If the right hand side is greater than GNI, then you get price inflation. This can happen in two ways, either or

.

Now we can draw three very important conclusions from this simple analysis.

(1) Firstly, the natural rate of interest is not stable, it depends on those real factors which determine the marginal rate of return on capital. My own preferred narrative is that every so often a disruptive technological shock comes along, like mass production, and suddenly there is lots of very productive capital spending opportunities. In order to get more savings to meet demand for capital spending, interest rates rise. Slowly the economy fills the available capital opportunities through innovation, and so we get a slow and steady decline in the natural rate of interest, until we get the next technology shock. Demographics are also an issue, as saving behaviour is not constant for individuals over their lifetime. In short, high interest rates signal high demand for capital.

(2) The accounting identities like GNI=GDP, and S=I, so familiar from classical economics, are equilibrium conditions which do not need to hold in the real world. They implicitly assume that expenditure and income occur at the same time. The insight that there is a time lag between income and expenditure, creates the conditions for the possibility of disequilibrium. We can also frame this as an expectations issue. If I foresee declining income, I can reduce expenditure now, either way, it is the difference in time between expenditure and income which creates the possibilities.

(3) Now, if we hold potential production constant, then we get inflation, essentially, if GDP now exceeded the previous time period’s income. The paradox of thrift is now easily explained. We set the interest rate at the natural rate, such that S=I, and we have no deficit so GNI*T=G. All of a sudden there is a real shock causing a fall in income. If we allowed perfect elasticity in the price level, we get instant deflation, and say’s law is enforced. In practice, we get a stable price level and falling real output. This results in unemployment. Those workers who are still employed are now over capitalised. Thus capital spending falls. Of course, due to unemployment, saving also falls, but barring an absurdly fortune cancellation, savings will no longer equal investment, at the current interest rate. In other words, real shocks shift the natural rate of interest, and produce monetary disequilibrium. This is what Keynes called the paradox of thrift: People save too much in a recession, however, what really happened was that the natural rate of interest is lowered, and hence, money is much too tight. This means that monetary policy essentially causes the recession by not being omniscient. If we want to return GDP to potential, we must shift the interest rate, or increase G. These are basically equivalent strategies. (As economist Hulk tweets:HULK CONFUSED BY @EDBALLSMP. WANTS FISCAL STIMULUS BUT TO KEEP 2% INFLATION TARGET. HULK NOT AWARE OF MACRO MODEL WHERE THIS MAKES SENSE. ) Both will raise GDP compared to GNI. Monetary dominance is also a feature here. If we assume that the central bank will manipulate the interest rate so as to produce two percent inflation, that means that the central bank chooses an interest rate such that GDP exceeds GNI by two percent, by insuring that the interest rate is chosen such that . This expresses monetary dominance, whatever deficit a government runs, the central bank can choose an interest rate such that this equation is enforced (ignoring the ZLB).

When a student asked Richard Feynman for advice to graduate students, he wrote a single word on a piece of paper:

Disregard.

His point being that if you want to advance understanding, you should pretty much ignore the consensus. Of course, that is a bit easier to do if when you hand in your thesis you have already produced seminal contributions to Quantum Field Theory and helped build the atomic bomb. Perhaps not great career advice for us lesser mortals. Anyway, my point is that I have really no idea if the idea’s laid out above are common knowledge in economics or not. I like economics, but I have limited time, and its not my only hobby. 🙂 I would like to build an economic model that is tractable and comprehensible and demonstrates monetarism in action. This post is hopefully a first step in that direction. Its certainly the first collection of thoughts that I have managed to gather up into a reasonably coherent framework. I had fun thinking about this stuff, so I hope you guys enjoyed reading about it.

EU Governance Train Wreck: Spanish Edition

Spanish unemployment just passed 27% and it just keeps on climbing. Its unemployment rate is now equal to Greece’s, and they are both still climbing.

Even if the ECB adopted appropriate measures tomorrow, it would take years for unemployment in these countries to normalise. Its just completely gratuitous and endless pain. A lot of commentators are phrasing this along the lines of “how much are Spanish electorates prepared to take”, but my own opinion is that it is more a case of “who are the spanish electorate going to blame?”. If they blame the ECB, then it is near certain that they will leave the Euro, but I do not have a high opinion of the public’s grasp of matters monetary. If they choose to blame the centre right governing parties who, though admittedly clueless, are largely rabbits caught in a trap, then we might be about to see the rise of extremism. Spain has a long and troubled (recent) history with both communism and fascism, and that must make Spain much more resilient to these pressures than most, but where is the electorate to go?

The Cyprus bailout makes it clearer, whatever the commission says, that Spain cannot expect large scale help. If the Germans were not prepared to bail out a state smaller than Catalan, they are unlikely to bail out the Eurozone’s fourth largest economy. If you want a quick snap shot on what the bailout means for the future prospects of the economy, its often a good guid to look at the stock markets in the periphery. Here is the IBEX:

The IBEX for the last month. Its post Lehman low was about 6800, its decade low was about 6000 last summer. So its lost a goodly proportion of this year’s rally in the ten days since the Bailout was announced.

It really is an impressive comment on EU governance, that last summer, after five years of crisis resolution, investors thought Spain’s future was bleaker than it did after a global financial crisis tipped the entire world into economic meltdown.

Spain’s future will continue to get bleaker until the ECB engages in appropriately accommodative policy. On the plus side, the ECB seems determined to turn the once in a lifetime buying opportunity post Lehman, into at least a twice in a lifetime opportunity. If you missed out last time, tuck some cash away and wait for the Eurozone to explode.

Cyprus Updates

I have always enjoyed the posters at despair.com, if you are bored one day i recommend it. When I heard the details of the Cyprus deal I was reminded of the above poster. No real analysis today, just thought that I would collate the views of some of the web’s most respected economic commentators on the likely outcome of the Cyprus deal:

Here is FT Alphaville,

Cyprus is likely to suffer substantial deleveraging and a severe credit crunch, which will only make the recession worse, in our view.

Tyler Cowan thinks

Output on the island could easily decline by 25% or more, and I don’t think that will involve much subsequent mean-reversion. There will be a deflationary shock, an uncertainty shock, an “austerity shock,” a credit contraction shock, and a few other negative shocks as well. The Cypriot government will not be fiscally well situated to support the safety net or automatic stabilizers.

Even The Wall Street Journal, cheerleader for austerity and the confidence fairy reports

“We think the peak-to-trough decline in annual real GDP will be in the order of 23%, similar to Greece, but we see risks more on the downside than the upside,” he says.

Felix Salmon over at Reuters, in an article titled `Cyprus: Its not over yet’ thinks

the hit to Cyprus’s GDP is going to be so enormous that staying in the euro over the long term, absent another round or two of massive debt relief, is going to be extremely difficult.

Paul Krugman says,

There’s still a real estate bubble to implode, there’s still a huge problem of competitiveness (made worse because one major export industry, banking, has just gone to meet its maker), and the bailout will leave Cyprus with Greek-level sovereign debt.

David Beckworth despairs,

The current Eurozone approach is the equivalent of an economic whack-a-mole game that never truly solves the problem. The Cyprus crisis is just the latest mole to stick up its head.

Also worth a read is the Beckworth post on German Bias in ECB policy.

Matt Yglesias addsto the consensus:

Is Cyprus now saved? Absolutely not. Even if nothing goes wrong, you’re talking about the destruction of the island’s main high-value industry and a huge evaporation of local wealth. The ensuring depression is going to be sufficient to make problems for Cyprus’ remaining banks even if everything else goes fine.

I will let Lars Christensen, Riksbank member, have the last word:

But why do we continue to debate the terms for bailouts in Europe? Because we got monetary policy terribly wrong. Had we instead had proper monetary policy rules in Europe then we would not have these problems.

So, not one of the economics bloggers that I respect/follow think this is anything other than an unmitigated disaster for Cyprus. But don’t worry, its now the template for future rescues. And you know that must be true, since they have rushed to officially deny it

The Continuing Train Wreck of EU Governance: Cyprus Edition 2

Today the European Manufacturing index came out. I might as well just quote from the FT:

Of particular concern was that the “flash” Eurozone composite purchasing managers’ index, which fell from 47.9 in February to 46.5 in March, was aggregated before the eruption of the Cypriot banking crisis.

What is it that the ECB doesn’t get? No NGDP growth, no RGDP growth. Simples. Eventually, economies might manage to deal with endless deflation, and you can have the Japanese solution, of not quite zero RGDP growth for decades. How did it get to the point where that is the best that we can hope for is policy that is depressingly bad but not quite hopelessly destructive.

Is it so hard to understand? Ben Bernanke was a fierce critic of Japanese policy, and has managed to get the Fed to move in a reasonably positive direction, and low and behold the US economy is going from strength to strength. Who could have predicted that an appropriate monetary policy would lead to an actual recovery? Now BOJ, having for years maintained it was powerless, despite having a QE program designed to prevent deflation which did indeed move inflation to zero, has decided that twenty years of pointless misery is enough. Since it looked like Abe was going to get elected and force an explicit two percent inflation target on the BOJ, the Nikki is up from 9000 to 12,600, and is still on a charge. The markets understand monetary policy dominance. Inflation expectations in the bond market have changed quite dramatically since the BOJ first made noises about serious easing.

I am already tired of hearing about Cyprus’s run away banks. At least in the case of UK and US banking systems they could hide behind the Fig leaf of excessive leverage and risk taking. Cyprus’s banks had zero leverage. As in none. The did not even have outstanding bonds to default on. They were the safest banks imaginable. It turns out, that when you have a sector who borrows short and lends long, like any nice safe retail bank, and then your central bank decides to engineer a steep fall in nominal growth targets such that all assets and wages fall sharply, then your banking system cannot survive. WHO KNEW? I mean besides, what were the banks meant to do? Stop taking retail deposits? Haven’t we just had a big campaign about how retail banks in the UK, funded by deposits and divorced from `risky’ investment banking will be much safer.

Also, the question no one is asking, do people really imagine that if Cyprus had a smaller bank it would be avoiding the problem? No it would be having the same problem on a smaller scale.

This isn’t even the end of the pain for Cyprus, it is the beginning of the Greek death spiral. Suppose they successfully stump up the money for their bailout, well you are talking about a large fraction of the monetary base of the country leaving, either through money stumped up to the EU or capital flight. Then you get deflation, and a sharp fall in nominal wages and asset prices, which causes another Banking/sovereign debt crisis. Just wait, any minute now people will start talking about an asset price bubble in Cyprus. Oh no wait, its already happening.

The worst part of all about the Cyprus crisis, like the Greek crisis, is that the ECB could just pay. The ECB could have bought all of Greece’s debt when it was trading at pennies on the dollar and retired it as part of a sensible reflation package. The Fed has expanded its balance sheet by something in the vicinity of three trillion dollars, with a funds rate of 0.25%. That is what accommodative monetary policy looks like. The ECB has a 0.75%, and with the dubious exception of Liquidity assistance to banks via LTRO, has done exactly nothing. The entire stock of debt of all of the Eurozone countries together is about 8 trillion, so given that the EU is slightly larger, and had a slightly worse financial crisis than the US, and hence needs more monetary support, it is quite plausible that the ECB, in its normal operations of generating some demand, could have bought over half of the entire debt stock of the Eurozone. In which case it would be earning more interest every day than the total GDP of Cyprus.

Why have Eurozone governments decided that it is a bad idea for the ECB to monetize government debts at a time when it can do so for free. If the ECB announced tomorrow that it intended to hit a 5% NGDP growth target for the Eurozone and intended to do it by monetising and retiring government debt in unlimited quantities, this crisis would go away tomorrow. It would be forced to buy more in countries like Greece and Cyprus than in Germany, as NGDP is not currently distributed evenly across the continent. It would be a win for everyone. Germany could stop bailing out the south, the south could adjust wages, and Germans would get increases wages. WIN-WIN-WIN. It is literally the biggest free lunch in history, and a misguided political elite are instead imposing misery on an entire continent out of sheer incompetence.

The Slow Motion Train Wreck that is ECB Governance: Cyprus Edition

It is really, truly, colossally staggering quite how wrong the troika seems to be about this crises, its causes, and its solutions.

I banged on in my previous post about the importance of NGDP. NGDP is, essentially, demand. A large rise in NGDP will be split between RGDP and inflation depending on how responsive supply is to increases in demand. This split is not stable. It bears much resemblance to the arguments about money multipliers – if the multiplier is high it means a rise in NGDP will come in mostly RGDP, and little inflation. If they are zero you will get only inflation.

The same point is true in reverse. If you have a large fall in NGDP then it will be split between a fall in RGDP and deflation. One of the major problems in this crises has been that the the CPI the developed countries has not reflected this deflation. This is because wages are sticky, and so prices do not fall easily or quickly. Instead we get large unemployment and stagnant wages, possibly for years, until productivity increases make it possible to rehire workers at their original wage (since you seldom fire you’re entire workforce you can seldom rehire fired workers at lower wages than your current workers).

There is one place where this deflation does show up very clearly, and that is in governments and municipal budgets. Falling NGDP means falling tax revenues, and this puts pressure on wages. The result is that deficits have skyrocketed, resulting in a wave of municipal bankruptcies and even sovereign defaults. These are about the failure to meet nominal claims. If I am a government and agree a five year pay deal, I did that on the expectation of a certain level of inflation, if there is less inflation I am paying my employees more in real terms. In the US inflation is cumulatively about 7% below target since the crises. That means you would expect, all things being equal, a 7% budget deficit. Automatic stabilisers adjusting to large unemployment make things worse in practice.

A second place this shows up is in mortgage defaults. I have a nominal claim to pay $X a month for my mortgage. This is independent of the real value of that money. So among those who were lucky enough to keep their jobs, falling real wages causes an undermining of their ability to pay nominal contracts. This, if it goes on long enough, eventually undermines the stability of financial institutions. While certainly there was some risk taking in banks, by and large their ability to pay was based on the belief that central banks would keep NGDP growth more or less on track. It is no surprise at all that US banks, where the Fed has supported the recovery more or less appropriately, are back in a strong position. EU banks continue to wither, and Japanese banks have spent 20 years as zombies.

The key point is that NGDP falls inevitably cause financial crises if they are sustained. In the eurozone, where tight money continues to choke of NGDP growth, we are slowly working our way up from the bottom in causing financial, and then sovereign defaults. Here is a list of Eu countries by NGDP growth rates:

Notice anything about the bottom countries? Thanks to David Glasner for compiling this chart

The lower NGDP growth is below trend, the quicker the crisis comes. So Greece first, then Ireland, next Spain, then Cyprus. Portugal is doubtless coming. I don’t know anything about slovenia. France is missing its deficit reduction strategies. This is not a symptom, this is the cause. NGDP is completely within the control of the ECB. It is simply allowing eurozone NGDP to stagnate, to the misery of all concerned.

We are witnessing an abject failure of ECB governance, aided and abetted by the complete and dismal failure of the EU policy elite to grasp the problem at all. George Osbourne was quoted today saying that Cyprus’s problems were caused by too much debt, when in fact they were one of the best looking countries by debt statistics pre crisis.

So, if, beyond my bad tempered rant, I have a point, its this: Cyprus, this wasn’t your fault, and there’s nothing you can do, so leave the euro before the abject policy failures of the ECB and the EU condemn you to decades of pointless misery. Also, Portugal: You’re next.

Volatility Arbitrage, and the changing markets

The Black-Scholes analysis underpins much of modern financing. Today I am going to take an axe to one of its primary underpinnings. The Black-Scholes analysis depends, among other things, on the idea that volatility can be represented by a single number which is independent of the time over which you mention it.

Suppose that we have a random walk made up of randomly sampling a probability distribution, plus a general tendency to move in some direction. I.e. . Now since dX samples randomly from a distribution with variance

, we can expect that it is time dependent. If the variance can be represented by a single parameter, then since

,

then its clear that for a random walk if we sample over a time that is twice as long, (i.e., contains two samples from the distribution X added together), then we have , and hence we must have

, thus obtaining Ito’s Lemma by inspection.

Now if the market were perfectly efficient, we would know that this must be the case, since if it is not the case, we can obtain an arbitrage opportunity in the following way. (Today we ignore all frictions and transaction costs). Suppose that I have £1,000,000 in cash, and so I decide to take a short position worth £1,000,000 in some index, say the FTSE100 while simultaneously taking a long position in the same index. The only difference is that I am going to rebalance the long position at the open and the close every day to be worth exactly £1,000,000 by using my cash to buy or sell as needed, whereas I will rebalance the short position only every thirty days. The idea is that if volatility is greater on a day to day basis than on a thirty day basis, then by buying high and selling low I can make an incremental profit while, in the main, being hedged against market moves. The open and close data for the FTSE100 is widely available. Ideally I would like to have the tick data so I could look at rebalancing on shorter timescales. Sadly that data appears to be very expensive :(.

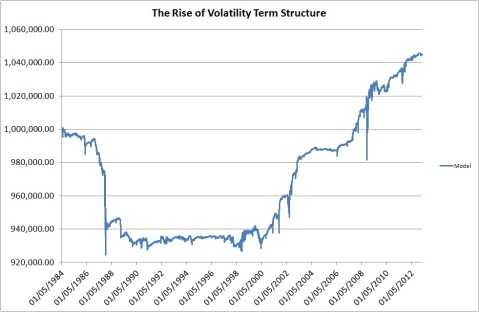

Anyway, here is the result of the strategy on the FTSE100 since 1984.

I find this graph fascinating. We are looking at the evolution of the market in action. In essence, from 2000, we see the emergence of a term structure, after which the strategy routinely makes money. Note that as we are very close to Beta-neutral, this strategy can be levered up and would need to be, as the absolute returns are not exactly great. However, note that the volatility of the underlying instruments is likely to be much greater than that of the composite index, so the returns would be greater if we applied this strategy individually to each of the constituents. That would mean much more work for me to back test it. 🙂

I suspect that the change in term structure is related to the rise of algorithmic trading. In essence, this strategy is the opposite of trend following. If you trade based on trends, you make the trends shorter and steeper and hence increase volatility. Its plausible that this results in higher volatility on short time scales compared to longer ones. An alternative explanation is that options trading has calmed longer term volatility.

Another interesting feature of this term structure applies to options pricing. Since options are priced via Black Scholes based on the volatility, and since measuring volatility on a monthly rather than a daily basis would give you different measures of volatility, then they will also give you different prices. This is already known in finance, where the implied volatility of longer term options is often less than that of shorter term options.

Still, its fascinating to me to watch how the evolution of the market and trading ideas has created an inefficiency which did not appear to exist in the past. Probably some Quant based Hedge funds are already trading on this idea, and as it becomes more heavily traded it will disappear.

Valuing Companies: Apple Edition

So I am considering a long position in Apple. This post will serve as my investment case, an attempt to apply the mindset of Graham and Dodd. I have a shares Isa, in which I hold a portion of my savings. I try to find undervalued companies and sectors, and aim to hold for a longish time period. My current holdings are BG Group, Man Group, Lamprell, Schroder’s Real Estate Investment Trust, and a hedged Nikki positions through the MSCI Sterling hedged ETF, Cazenove Smaller Companies Fund, and Standard Life Equity Unconstrained.

Firstly, I will set out how I think about valuing companies in the abstract. As a shareholder, you live in a gray area of the investing landscape. You have a share in the assets and liabilities of the company, and also a share in current and future profits. I like to think about how a share price reflects a company as a going concern, which means I need to strip out of the market capitalisation those assets and liabilities that are independent of daily operations. Most commonly this involves bond issues. Bonds are more senior than equity, so they get first bite at the profits and also, in the event of bankruptcy, first claim on the assets. Thus, to understand how the market is valuing a company, we need to add its liabilities to its market cap. Similarly, in the unusual event of a company having a very strong net cash position, we should subtract it from the market capitalisation.

We can imagine, as it were, that the “market value of a business” = Market Cap + Liabilities – Non productive assets. We should not include such things as factories or offices, or those assets that are necessary for the daily operations of the company. The reasons for this are laid out in Graham and Dodds weighty tome “Security analysis”. When one comes to value a productive asset, its value is usually how much it produces. A company usually only sells such assets when they are no longer profitable, in which case there is no reason to think another company could profitably employ your factory, so its value drops to its land value. As an investor, we cannot know for certain how a company is valuing its productive assets, so in the interests of safety, assume you will get nothing from them that is not fully factored into the profit expectations.

Apple produces an interesting test case for this way of thinking, as its strong cash position materially affects its market cap, despite having almost no debt. According to its most recent 10-Q (interim statement for UK readers), it has around $68.7bn in liabilities, and around $158.6bn dollars of non productive assets, mostly in long dated securities and cash. The enterprise value of Apple is therefore its 400bn market cap, less $70bn in net non productive assets, for $330bn. This is the value that should be used for PE ratios. Last years apple earnings were around $41bn consensus estimates suggest it will be around $45bn this year and $50bn the year after. This gives an effective PE ratio of around 8. To put this in perspective, Google is valued at around 24 times earnings, Microsoft and Oracle are measured at around 15 times earnings. (In fairness, these are just the values from the FT website, not the adjusted values I laid out above for apple). This suggests to me that Apple is pretty cheap for a Tech company. Mean reversion is the most powerful force in market dynamics, so I would expect to see this valuation gap resolve itself one way or another.

As is often pointed out, the stock market is a forward looking vehicle, so let us ask what this stock price is predicting. To me this suggests that the Stock market is expecting Apple earnings to halve. If they did so then Apple would be fair valued as a tech company at around 15 times earnings. This does not seem plausible to me. It is true that as smart phones have become a commodity margins are likely to come under pressure, and that Google is at a huge premium because the market is very excited about driverless cars and Google glasses. Apple has always been extremely secretive about product development, are we certain that Apple does not have another game changing device up its sleeve? Apple has a fantastic brand, and huge brand loyalty. Smart phones are a fast growing market, and so we could easily see Apple maintaining earnings even with falling margins. Moreover, the corporate culture of excellence that Steve Jobs built is likely to persist.

Market Timing

So we have set out a value case for Apple. However, market sentiment is a strange beast, and its clear that Apple is in a monster downtrend. Do you fight the trend? Do you catch a falling knife? Well, this is an area in which it helps to look at the big picture.

So the question is, are we going to break through the support at $420? If it does, we are likely to see another big move lower, down to 380 or so. At the moment the chart looks squeezed between the top of its down trend and the support line. Over the next few days it will break out either higher or lower. The risk of buying now is that it might go lower. The risk of not buying is that it might break out to the up side by some 20% or so.

In such situations my inclination is not to bother too much with the charts. I intend to hold for a long time (two years at least), and so a temporary downwards movement is not such a big deal. Apple is a strongly cash generative company disconnected from its fundamentals (in a good way), so I see a buying opportunity. If your plan is to ride a short move, you have been warned.

Disclosure: I will probably initiate a long in Apple later today.

Cultural Treasures, UK edition: The Natural History Museum

Awesome

I had occasion to visit the museum of Natural History yesterday, and it is really really really good. Not only does it have one of the best collections of fossils in the world, it also has a truly incredible mineral collection. You can see valuable Gems in their natural and cut states. Anyway, among these various exhibits I have discovered a very special treat. Here is a picture of a Gem known as Alexandrite:

One Gem or Two?

Alexandrite is fascinating because it changes colour based on ambient light conditions. There are two effects at work here. The first is called Pleochroism. This occurs when a crystal has an anisotropic structure, which means that it responds differently to photons depending on the orientations of the Electric field. This is known as the polarisation axis of the photon. Daylight is partially polarised, and hence, anisotropic crystals look different colours when viewed from different angles. Here is an example of a strongly Pleochroism topaz, from the Wikipedia page,

Changing the camera angle results in a different colour, since it changes the relative angles of the polarisation axis of the photons and the optical axes of the crystal.

However, Pleochroism, while interesting in its own right, is not Alexandrite’s most distinctive feature. It also changes colour under unpolarised light in the right conditions. The picture taken above has the same gem under Daylight (green) and an ordinary tungsten filament lamp (what you have in your house….probably). The reason for this is that Alexandrite absorbs extremely strongly in the yellow region of the visible spectrum, about 600nm, with a very narrow band. If we compare daylight to a tungsten lamp, we obtain

Lots of different lights.

and by looking at the transmission spectrum of Alexandrite we get

See that peak at 400-500nm, exactly where tungsten and daylight have their maximum difference.

so we see that since sunlight has significantly more blue (400-500nm) in it than tungsten, it strongly affects the colour balance of the stone, and blue and yellow together make green. Under Tungsten lamps, the blue almost disappears, and we end up just on the red side of yellow.

Sticky Wages

This is a very quick observation to reblog a graph from a Krugman Column. Namely:

Further evidence of deflation.

This odd looking spike is further evidence that the US would be in deflation were it not for nominal wage rigidities. See my previous post for a more indepth comment.

Is Equity Cheap?

This is the question which is dominating financial media at the moment. Case-Schiller point out that their cyclically adjusted PE ration (CAPE10), is above historically adjusted norms. My thesis in this post is that the CAPE10 actually indicates that the stock market is cheaply-fairly valued depending on the expected future path of interest rates. In fact, I am going to use Shiller’s own data to explain why I think he is wrong.

Equity Valuations

The most theoretically sound way to value equities is the present discounted cash flow. That is to say, the current intrinsic value of a stock is the sum of all future profits discounted by the risk free rate. Of course, we can never be sure about the future, so is born the concept of a risk premium, that equities should be valued slightly lower than their fair value because we have a high degree of uncertainty about the future. My preferred way of saying this in maths is:

where we have defined that R is the risk free interest rate, G is the growth of the company, and $\latex \rho$ is the equity risk premium, which is at heart, the uncertainty about growth and interest rates. The approximation follows from the formula for a geometric sum if one assumes that is small. Obviously, such a valuation builds in some fairly crucial assumptions. Firstly, that growth is smaller than the interest rate and the risk premium. A share whose earnings growth continually out earns interest rate and uncertainty premiums is worth infinity. Of course, this occurs because we assumed growth was a fixed parameter, which it is not, but such simplifications are sufficient for our current purpose.

Using the Case Shiller data, and using the above analysis, I have plotted the PE ratio for ten year US treasuries along side the CAPE10 ratio for the S&P500, since 1950.

Notice the incredible correlation between bond returns and equity returns over the proceeding decades as tail risks of WW2, the cold war, and thermonuclear war abated.

So the question, “are stocks cheap”, is now seen in its proper context. Stocks are cheap if you expect interest rates to stay at their current levels for an extended period. If you expect that interest rates will normalise around 5% in the not to distant future, then stocks are fairly valued. I see think that interest rates are still some years away from 5%, and see rather evidence of continued tail risk from the Eurozone’s self inflicted misery. Notice quite what an aberration the tech bubble was. Even at the end of the dot com crash stocks were not especially cheap compared to bonds. Notice that stocks were incontrovertibly cheap post financial crisis in 2009. Anyway, I am cautiously optimistic in the long run/medium run for stocks, but still worried about the Eurozone. The ongoing crises in Europe seems temporarily in the background of investor’s minds, either because they believe that the ECB will bow to pressure and follow the other central banks, or because they believe that liquidity from other parts of the world will alleviate Europe’s problems despite ECB intransigence. I would not bet on either.

Disclosure, I am 30% in cash, 70% long equities, with 0% European exposure.